Proof-of-work crypto mining generates a lot of externalities. Yesterday’s post was about how not to measure those externalities. Today’s is about how to deal with them.

When miners use vast amounts of power, there are two broad categories of externality to worry about. One is environmental damage associated with power usage. Insofar as that’s a social problem, the way to deal with it is to tax power usage. That is the government’s job.

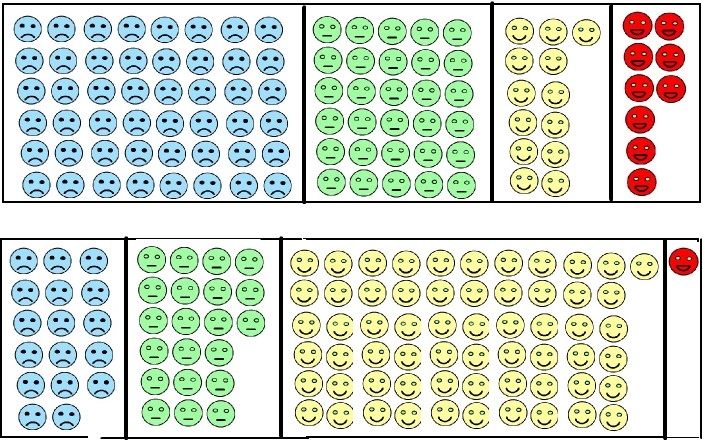

But the other kind of externality is more interesting from a crypto-design point of view. Miners are engaged in an arms race. Each miner makes the system a little more secure. Each miner earns an expected reward for that contribution. But there’s no reason to think that the miner’s reward is commensurate with the social value of the extra security that miner brings, and in fact there are plenty of reasons — at least plausible and possibly compelling — to believe that miners are over-rewarded. Currently, if you complete a Bitcoin block you earn a block reward of 6.25 bitcoins plus transaction fees that seem to be running somewhere around a tenth of a bitcoin, adding up to something in the vicinity of $300,000. It’s a fair guess that miners earn pretty close to zero economic profit, so their costs should be about $300,000 per block or roughly $45 million per day. Society is certainly getting something of value for that $45 million, but if it only takes, say, half as many miners to provide the same value, then we’re overpaying by $22.5 million every day (that being the value of the essentially wasted energy).

[it’s also entirely possible in principle that there is too little mining, in which case you can interchange all the implicit plus and minus signs in what follows.]

If you subsidize something and you get too much of it, the solution is to lower the subsidy. In this case that means lowering the block reward. If you don’t subsidize something and you get too much of it, the solution is to tax it. In this case that means a negative block reward. I don’t see any reason in principle why you couldn’t have a proof-of-work system with negative block rewards, and I think it’s at least plausible that such a system could be optimal. [The way this would work in practice is that the block reward would be subtracted from the transaction fees and then burned.]

A potentially nice side benefit is that you’d be taxing that environmental damage we talked about at the outset. You might believe as I do that if there’s a case for taxing that damage, it ought to be done by the government, not by the Bitcoiners. But if you believe your elected officials are falling down on the job, and if doing part of their job for them is an automatic side benefit of getting your own house in order, that’s a good thing.

I haven’t thought about any of this quantitatively — meaning that I have nothing to say about estimating the optimal tax rate, but there is, I think, a moral — namely:

It is often said that proof-of-work systems inevitably lead to a lot of social waste. The “inevitable” part can’t be true. It’s easy for the system to levy a tax that brings private rewards in line with social benefits.

Of course one possiblity is that with the optimal tax, transaction fees would not be enough to support the miners, in which case the system would collapse. But with such a small transaction demand, the system should collapse, so that’s not a problem.

I am sure that a lot has been thought, and a lot has been written, about optimal block rewards, and equally sure that I’m unfamiliar with most of it. So maybe a reader or two will contribute to my education here.

So I was clicking through the stations on Sirius XM and came upon a rebroadcast of an old

So I was clicking through the stations on Sirius XM and came upon a rebroadcast of an old  The death of Bernie Madoff reminds me that I never understood why he was so vilified. He ran a Ponzi scheme. All of his investors knew it was a Ponzi scheme. They chose to get in, and gambled that they could time their exits just right. Some succeeded, some failed. So Madoff was the moral equivalent of a bookmaker (and not the kind of bookmaker who employs violence to enforce collections). He catered to a preference that some might call a vice. Where’s the problem?

The death of Bernie Madoff reminds me that I never understood why he was so vilified. He ran a Ponzi scheme. All of his investors knew it was a Ponzi scheme. They chose to get in, and gambled that they could time their exits just right. Some succeeded, some failed. So Madoff was the moral equivalent of a bookmaker (and not the kind of bookmaker who employs violence to enforce collections). He catered to a preference that some might call a vice. Where’s the problem? Over four years ago, I

Over four years ago, I