Somehow we’ve gone a month since the last weekend roundup. So this will reach back a little further than usual in time.

Riddles. We tackled some riddles: Why do guys with deep pockets take on risky ventures instead of selling them off to someone with nothing to lose? Why, when a plane headed for Atlanta is diverted to Greenville, does everyone else choose to stand for an hour at the ticket counter while I (and only I) saunter over to the Hertz counter and grab one of many available cars? And why does Jet Blue, after investing $800 million in its new terminal at JFK, choose to make that terminal so hellish a place that I for one will never travel through it again if I can possibly avoid it?

Paul Krugman. Yes, I know, I can’t seem to let this topic go. I was at it here, and then here, and here and finally here.

Let me summarize my complaint in a paragraph: Krugman has some policies he’d like to see enacted. Some people oppose those policies for silly reasons and others oppose them for sensible reasons. Krugman habitually ridicules the silly reasons and pretends that he has therefore dispensed with the sensible reasons.

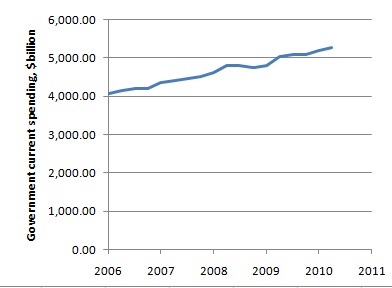

More specifically, Krugman attacks “deficit hawks” but ignores the “spending hawks” who present a much stronger case for fiscal restraint. He’s right to attack the deficit hawks, who make the silly mistake of conflating spending (which is costly) with tax cuts (which are not)—but then he makes the same mistake himself when it suits his purposes.

Incidentally, my Toy Stories post contains a link to a toy model intended to highlight the key questions that Krugman willfully ignores. At the end of that post I added an addendum confessing to arithmetic errors in the model and inviting readers to correct them. On a second reading, I realized there are no arithmetic errors—just one typo in an equation. Because some comments refer to that typo, I’ve chosen not to correct it, but it’s explained in the current addendum to the original post.

Books. Our book posts covered everything from the ridiculous to the sublime to the magnificent.

Math. The music of the primes gives a glimpse of the glorious intricacy of arithmetic, and our post on Fermat’s Last Theorem gives a small taste of how to tackle a particularly vexing problem.

Videos We had videos on cruel and unusual punishment, on the end of racism, and on how to fix everything.

Miscellaneous. Can Mike Huckabee possibly believe the things he says about religion? Does anyone still subscribe to the superstition of dollar cost averaging? And why the disproportionate outrage about an oil spill in the Gulf when there’s so much more to be outraged about?

Okay, we’re more or less caught up now! See you Monday.

One of Paul Krugman’s favorite stories is about the baby-sitting co-op that almost collapsed when members started hoarding scrip; similarly, he says, a lot of economic activity can dry up when people start hoarding money. Last Tuesday, in a post called

One of Paul Krugman’s favorite stories is about the baby-sitting co-op that almost collapsed when members started hoarding scrip; similarly, he says, a lot of economic activity can dry up when people start hoarding money. Last Tuesday, in a post called