Today’s lesson is about the Keynesian multiplier.

Today’s lesson is about the Keynesian multiplier.

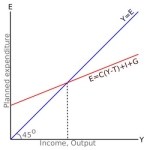

If you studied economics from one of the classic textbooks (like Samuelson) you might remember how this goes. We start with an accounting identity, which nobody can deny:

Here Y represents the value of everything produced in (say) a given month, which in turn is equal to the total income generated in that month (because producing a $20 radio allows you — or perhaps you and your boss jointly — to earn $20 worth of income). C (which stands for consumption) is the value of the output that ends up in households; I (which stands for investment) is the value of the output that ends up at firms, and G (which stands for government spending) is the value of the output that ends up in the hands of the government. Since all output ends up somewhere, and since households, firms and government exhaust the possibilities, this equation must be true.

Next, we notice that people tend to spend, oh, say about 80 percent of their incomes. What they spend is equal to the value of what ends up in their households, which we’ve already called C. So we have

Now we use a little algebra to combine our two equations and quickly derive a new equation:

That 5 is the famous Keynesian multiplier. In this case, it tells you that if you increase government spending by one dollar, then economy-wide output (and hence economy-wide income) will increase by a whopping five dollars. What a deal!

Now, though I cannot seem to find a reference, I have a vague memory that it was Murray Rothbard who observed that the really neat thing about this argument is that you can do exactly the same thing with any accounting identity. Let’s start with this one:

Here Y is economy-wide income, L is Landsburg’s income, and E is everyone else’s income. No disputing that one.

Next we observe that everyone else’s share of the income tends to be about 99.999999% of the total. In symbols, we have:

Combine these two equations, do your algebra, and voila:

That 100,000,000 there is the soon-to-be-famous “Landsburg multiplier”. Our equation proves that if you send Landsburg a dollar, you’ll generate $100,000,000 worth of income for everyone else.

The policy implications are unmistakable. It’s just Eco 101!!

Yup. Link here: http://mises.org/rothbard/mes/chap11e.asp#17C._The_Multiplier

(Though the original argument is from Hazlitt cited in the footnote.)

We must remember that the multiplier is only applicable to particular economic times where there is spare capacity. Increases in spending can be taken up by greater production rather than increased prices. This constraint is crucial.

Lets look at how the Keynesian multiplier is derived. The Govt buys $1 services from me. GDP increases by $1. I save 20c and spend 80c. GDP incrases by a further 80c. Every person that receives the money to does the same. So we have 1 + 0.8 + 0.64 + 0.512…. We sum the series and we get a formula Multiplier = 1/(1-0.8). This is the same as the 5 in Steve’s example above. It only occurs because there is spare capacity, so the extra money that everyone receives can go towards production, not inflation.

Now look at the Landsburg multiplier. Govt. buys $1 services from Landsburg. GDP increases by $1. How do we now tie in the 0.99999999 in the same way that we did to derive the multiplier? There is no way that they relate in the same way.

There is a fallacy in SL’s comparison, but I am struggling to define it precisely. Either it is because the multiplier is not actually calculated in ther way described, although it happens to give the same answer, or some items are constants in one and variables inthe other.

Harold, doesn’t your argument leave out the bit where government taxes me a $1 to buy your services, thus reducing my saving by 20c and my spending by 80c, and reducing someone else’s spending by 64c and so on?

@2

The difference is in your attempt to justify the Keyenesian one you are providing a causal analysis that does not rely on the identity.

Which, subtly, is the point.

Classic! On a more serious note however, there are two particular GDP multiplier values, one for changes in government spending (0.6) and one for changes in taxes (-3.0), that would seem to keep showing up at work in the economies of some very different countries.

EricK – you’re forgetting that the government can also borrow money to spend.

Which means there is less money for the rest of us to borrow to spend but that’s just a silly detail.

No, wait, this is completely wrong.

In the first case, the multiplier was derived from a behavioral assumption, that individuals save 80% of their income and spend the rest. That leads to a function that tells you “If the government spends 1 dollar, how much does that increase total GDP?”

In the second case, you derived the multiplier from a statement about the world, not a behavioral assumption. So your equation holds true ONLY when Landsburg’s income is E = .99999999 Y. If you give Landsburg a dollar that equation is no longer true, so all that ‘multiplier’ tells you is what you already knew, that total GDP is 100,000,000 times Landsburg’s income.

@ Nick J,

There’s also a whole lot of other assumptions that Landsburg left out. Some of them are intermediate level stuff that takes into account the change in the interest rates, marginal taxation rate, etc. I think this was just a joke post poking fun at Krugman for always saying that we could make fiscal assumptions from macroeconomics 101. Then again, maybe Krugman gets into all the more complicated assumptions that bring the multiplier in line with a more reasonable value in his 101 course.

@4 – could you explain a bit more?

My point is that the Keynesian multiplier is not obtained by manipulating the equations above, but by summing a series. If it were obtained as above, then it would apply at all times, and we could all get infinitely rich by the Govt spending $1 and simply not saving any. Since Keynesians do not believe this to be the case, I think there must be an error in the comparison.

Prehaps that is a better question. Why do we simply not save anything and have infinite wealth? This may be a straw man. I am not sure yet.

Erick #3. I did not include that analysis. It is called the “balanced budget” multiplier, which is = 1. Thus if you spend $1b. and raise taxes by $1b to pay for it, you increase GDP by $1b.

The reason for this is that with taxes, the multilplier is not 1/(1-savings), but -(proportion consumed)/(proportion saved). All the Govt spending is added to GDP in the first cycle. Only the portion of taxes that is not saved is added for a tax cut.

Thus tax increase reduces GDP by less than the tax spend by the amount saved.

Any failure of the assumptions will of course lead to failure of the model.

@8 – Daniel,

Landsburg is not (only) poking fun at Krugman; he is poking fun at this whole mechanistic mindset that you can create wealth, just by simplistically pumping a gazillion dollars into the economy, which is, BTW, the whole Keynesian/Krugmanian/DeLongian/Stigliztian mindset. [And when you criticize them, they virulently attack you for being a “fresh water style” troglodyte, but that is another story…]

This whole mindset is incredibly ingrained into the psyche of many policy circles. In my state I have seen claims that tourism has a multiplier of 17 (yes, seventeen). The whole “Economic Development Agencies” of cities and states are build on this mindset – that when a company comes to the state or the town, the multiplier is 4 or 5 or 6 or 7.

[And not to speak when a major super-event like the Superbowl happens in town – those Economic Development Agencies go beserk in showing the “economic impact analysis” with sky-high multipliers.]

And there are economists making a living with this stuff, selling their Implan or RIMS II multipliers, and politicians just marvel at all of that. And then, when types like Manfred come along and say “look, there is no free lunch, a multiplier of 4 or 5 or 17 cannot be”, you are just laughed out of the room, because politicians just do not want to hear it.

@Daniel

I agree, but even ignoring all the complications, just within the simple Econ 101 framework this gets the basic math wrong.

C = 0.8Y is a function. It should be written C(Y) = 0.8*Y, or Y(C) = (1/0.8)*C. It tells you for each consumption level what people’s income is. Y = C + I + G is an identity. It should be written Y ≡ C + I + G. You combine the identity and the function to get a new function, Y(G) = 5(I+G).

Y ≡ L + E is another identity. But E = .99999999Y is NOT another function analogous to Y(C) = (1/0.8)*C. It is NOT true that Y(E) = (1/0.99999999)*E. Instead, it’s an equation that only holds true in one state of the world.

So the point is, in the first derivation, a function was combined with an identity to get a FUNCTION. In the second derivation, an equation was combined with an identity to get another EQUATION. In the second case, the equation ONLY holds in the world where Landsburg’s income is 0.000001Y. In particular once you give him a dollar it no longer holds. In the first case, it holds for ALL levels of government spending.

@Manfred,

All of the people you mentioned would not support a multiplier of 5 for the US economy. Nor would they say that in normal times you could increase economic output or increase wealth by pumping spending into the economy. The whole point is that good keynesians do believe that increasing government spending has an effect on business spending but only when real interest rates are not negative. You mention people who calculate local mutipliers and I agree that these people are snake-water salesman and not really keynesian economists.

@ Nick J,

I see that, but I just didn’t think Landsburg was being serious here because of how silly his argument was.

@9

In summing your series you are first assuming there is a series. Why should there be? Well you have a theory about how people will behave, and about what relations will persist after the amount is transferred. And it is from *those* not directly from the equation that you conclude that consumption and income will rise. In Steve’s argument about his multiplier that is missing. He is just arguing from an accounting identity. But what is that $1 sent to Steve actually set off a depression, via some causal chain we need not consider, in which the numerical relation L to the rest just happened to be the same. The we would all be poorer but Steve’s equation would still work. In my depression example the “series” is very different.

One commenter above got at the same point by distinguishing equation and function. A bit sloppy in mathematical jargon, but the idea is right.

I hadn’t really heard an explanation for the multiplier before, but if yours is accurate, the whole concept is malarky. Consider this with popluation. If the population is 80% civilian and 20% bureaucrats and military then P=5(B+M), so if an immigrant or extraterrestrial got a job as a bureaucrat, then the whole population increases by 5.

Shouldn’t it be Y=5(L+E)?

@Kevin L: Well your example, while engaging, doesn’t quite work unless the 80/20 is an identity — always true.

Steve,

Is that a straw man? Your implication seems to be that those who assume a “keynesian multiplier” take an observation of a ratio and translate it to causation — i.e., that they observe that observe the ratio of C to the other factors in GDP, and then assume a proportionally causal relationship such that increasing one of the other factors will cause an increase in C that is sufficient to maintain the proportions involved. Is that the premise you are attributing to some people? And if so, is that really their premise?

Also, if Y is intended as equal to GDP, don’t you need to add exports and subtract imports? (i.e., Y = GDP = C + I + G + X – M)

Nick J (#12):

Y ≡ L + E is another identity. But E = .99999999Y is NOT another function analogous to Y(C) = (1/0.8)*C. It is NOT true that Y(E) = (1/0.99999999)*E. Instead, it’s an equation that only holds true in one state of the world.

You’re right that E = .99999999Y only holds true in one state of the world. You’re wrong that this makes it non-analogous to Y(C) = (1/0.8)*C (or, as I wrote it, C=.8Y).

The latter equation *also* holds only in one state of the world, namely the state in which we observed it (which included, among other things, a given level of government spending). When government spending changes, there are all sorts of reasons why the equation C=.8Y might change in response. If the government buys you a car, you’re less likely to buy a car for yourself. If the government spends a lot of money on worthless junk, you (as a taxpayer) are going to find yourself poorer, and that too will affect your consumption habits.

So the point is a serious one: Of *course* when you give me a dollar, there’s no reason to think equation E = .99999999Y still holds, which invalidates the reasoning. And equally of course, when the govt spends an extra dollar, there’s no reason to think the equation C=.8Y still holds, which invalidates *that* reasoning.

None of this is to say that it’s impossible to build a sensible model that has a multiplier. What it *does* say is that the Eco 101 model of the multiplier is flawed in exactly the same way that the argument for giving me a dollar is flawed. And that’s an object lesson in making policy on the basis of arguments you learned in Eco 101.

Steve, here is Hazlitt’s original discussion of the multiplier, that Rothbard cited in his critique:

http://library.mises.org/books/Henry%20Hazlitt/Failure%20of%20the%20New%20Economics.pdf

It starts at page 135 of the internal page numbering of the book, or page 148 of the PDF.

@Steve Landsburg (#20)

I agree that Y(C) = (1/0.8)C may no longer hold once you start spending money in the ‘real world’. But it’s not flawed in the same way as your example because you derived the two multipliers using different logic. If you want to criticize the model for having unrealistic assumptions, then just criticize those assumptions. It doesn’t make sense to me to instead manipulate expressions which weren’t meant to be manipulated in the original model, unsurprisingly get bizarre results, then say “See!? You can get anything from any accounting identity!” All that the result ‘proves’ within the model is that the total amount of income is 100,000,000 times Landsburgs income, which is true by assumption.

Speaking of more dynamic models, I notice that some who ridiculed the notion of tax cuts paying for themselves now ridicule those who hesitate to accept the analogous claim for govt spending.

Nick J:

But it’s not flawed in the same way as your example because you derived the two multipliers using different logic.

I contend that in both cases, this is the logic:

1) Start with an accounting identity.

2) Write down an equation which holds under current policy but might not hold following a change in policy.

3) Combine these equations to get a third equation.

4) Do a thought experiment to determine the effect of a policy change. Predict the outcome of this thought experiment by using the equation derived in step 3), while pretending that that equation continues to hold.

My questions for you are:

A) Do you agree that this describes the “Landsburg multiplier” logic?

B) Do you agree that this describes the “Keynesian multiplier” logic?

C) If your answers were both yes, then does it not follow that the logic is the same in both cases?

D) If one of your answers was no, then which of steps 1) through 4) do you think is an incorrect description of the logic I presented?

Steven Landsburg:

I think your point (2) is ambiguously worded. I could see it meaning either (2.1) or (2.2):

2.1) Write down an equation that holds under current policy but realistically might not hold following a change in policy in the real world.

2.2) Write down an equation that holds under current policy in the model but might not hold following a change in policy in the model.

If you accept the assumptions of the model, then C = 0.8Y is a relationship that holds regardless of government policy in the model. I admit that a more reasonable model might not make such a restrictive assumption. In other words, C = 0.8Y satisfies 2.1 but not 2.2.

However, E = 0.9999999Y is a relationship that not only does not ‘realistically’ hold under a change in policy, it doesn’t hold under a change in policy within the model. So it falls under both 2.1 and 2.2.

So, if you meant 2.2 then my answer is: No, the logic is different, because C = 0.8Y is an equation that holds regardless of policy changes in the model while E = 0.9999999Y does not hold regardless of policy changes in the model, and step (2) is the offending step.

If you meant 2.1 then my answer is: Yes, the logic is the same, but that strikes me as a particularly poor way to criticize the model, since you are essentially identifying an assumption as unrealistic that the model itself says is unrealistic. Why not just criticize C = 0.8Y, which the model says is (unrealistically) invariant to policy changes, instead of using E = 0.99999999Y, which the model _realistically_ says varies with policy changes? If you meant 2.1 then it seems to me you’re mis-using something that the model gets right to criticize something that the model gets wrong.

@iceman 23,

I think the main problem is that keynesians believe govt spending to ward off depression is a temporary measure whereas tax cuts are permanent. So, some Keynesians believe that when responding to a liquidity trap with stimulus it is possible to reduce your debt/gdp ratio in the long-run, but this is stipulated on the assumption, possibly unrealistically, that the stimulus will end when we exit the liquidity trap. Permanent tax cuts by definition are not expected to end once we exit a liquidity trap and thus will not, from a Keynesian point of view, lower the long-run debt/gdp ratio.

This has probably already been said, but you have to interpret C=.8*Y as a behavioral equation. It says that people spend 80% of every dollar they receive. This implies a multiplier of 5 (the inverse of the leakage rate .2) If we interpret E=.99999999*Y as a behavioral equation (that is other people spend 99.999999% of every dollar they receive, indeed the multiplier will be 100,000,000 (the inverse of the leakage rate .0000000001) for any exogenous spending change. But you cannot assume other people will spend 99.999999% of every dollar they receive from the fact that their spending constitutes that much of total spending.

@1

Hazlitt in his book actually credits it to Rothbard:

“I am indebted for this illustration to a forthcoming book by Murray N. Rothbard.”

The Failure of the “New Economics”, Hazlitt, page 151

Nick J:

I think your point (2) is ambiguously worded. I could see it meaning either (2.1) or (2.2):

2.1) Write down an equation that holds under current policy but realistically might not hold following a change in policy in the real world.

2.2) Write down an equation that holds under current policy in the model but might not hold following a change in policy in the model.

If you accept the assumptions of the model, then C = 0.8Y is a relationship that holds regardless of government policy in the model. I admit that a more reasonable model might not make such a restrictive assumption. In other words, C = 0.8Y satisfies 2.1 but not 2.2.

However, E = 0.9999999Y is a relationship that not only does not ‘realistically’ hold under a change in policy, it doesn’t hold under a change in policy within the model. So it falls under both 2.1 and 2.2.

Aha! So you didn’t understand my model.

My model says that E=.9999999Y, which I discovered empirically and therefore incorporated into my model, is a relationship that holds regardless of policy. It is therefore entirely analogous to the role of the equation C=.8Y in the Eco101-Keynesian story. Therefore, in both the Keynesian story and the Landsburgian story, the logical step is 2.1), not 2.2).

Now you might say that it’s really really stupid to build an equation like E=.9999999Y into your model and assume it’s invariant under a policy change. To which I reply: My point exactly.

“There is a fallacy in SL’s comparison, but I am struggling to define it precisely” (and similar)

There’s no fallacy in his comparison. What’s happening here is,

for the Landsburg multiplier, he wrote:

“Dodgy Argument” implies “Ludicrous Result”

then, it’s easy to see why the argument is dodgy.

for the Keynesian multiplier, he wrote:

“Identical Dodgy Argument” implies “Reasonable Result, with the wrong number”

Since the result is reasonable (except the number 5 should be 1.5 for the period 2007-2013), it’s much harder to see that the argument made for it is complete rubbish. The argument seemed perfectly resaonable to me, until I saw it applied to produce the Landsburg Multiplier. (I admit I was tempted to send L a dollar and then wait until my share of the $100M started rolling in)

Since the dodgy argument (if correct, which it isn’t) should apply at all times, and since Keynesians don’t say that we can always improve the economy through government spending, we know they don’t rely on this dodgy argument to justify the existence of multipliers.

Mike H: Extraordinarily well put, even by your own high standards.

Steve Landsberg (25) says “Now you might say that it’s really really stupid to build an equation like E=.9999999Y into your model and assume it’s invariant under a policy change. To which I reply: My point exactly.”

But you can look at some data to see if there is any basis for C=.8Y

Here’s my FRED graph of (Real Consumption)/(Real Disposable Income)

http://research.stlouisfed.org/fred2/graph/?g=jKr

consumption/income is not a rock steady .8 (actually .9 was the number in my copy of Samuleson) But, the marginal propensity to consume doesn’t move around that much – a total range of .85 to .95 over decades. So, I don’t see how the multiplier is such a huge flaw in macro 101. It’s exact value might have some variation but from the data it seems C=.9Y is a pretty good first order approximation.

I’d also add that my graph seems to support the Keynesian macro 101 views that:

1) C=.95Y gave us a really great Y

2) A sudden drop from C=.94Y to C=.90Y gave us the great recession.

I think the real problem with macro 101 is it forces you to conclude that to get more Y we need to spend spend spend. If you won’t spend your last nickel then we’ll get Uncle Sam to spent it for you. If we could get the marginal propensity to consume to be .99999999 per NickJ’s (25) model interpretation then we’d all be as rich as Nancy Pelosi. This might work TODAY but as Samuleson points out in my textbook, even while he’s doing the Keynesian cups and balls, real sustainable wealth increases come from technological advances and those advances require investment which requires savings. Keynesians want to outlaw savings as long as there is one person who is still out of work. Do Keynesians really think the low savings rate at the peak of the housing bubble is something we want policy to get us back to?

Capt. J. Parker: MPC might move around within a predictable range — but if that moving around is in response to government policy, then, by ignoring that fact, you’re still going to get completely wrong predictions about the effects of a change in govt policy.

Nick J I think hit the nail on the head with this one, you’re confusing an accounting identity with a behavioral assumption.

Krugman talked about this fallacy here.

Also,

2) Write down an equation which holds under current policy but might not hold following a change in policy.

This I don’t think describes the Keynesian multiplier logic. Instead…

1) Start with an accounting identity.

2) Create an equation that explains whats causing the variables in the identities to hold.

^In this case, C=c0+c1(Y-T) are the variables that are causing C to hold within the Y=C+I+G identity (for a closed economy).

@Steve Landsburg

We all agree that the assumption that individuals spend 80% of their income on consumption independently of government policy is a dodgy assumption. Only the Econ 101 model says that’s true.

We also all agree that E = 0.9999999Y independently of policy is wrong. The difference is, which you should acknowledge, that the Econ 101 model agrees that it’s wrong too, as a matter of simple arithmetic. E = 0.999999Y doesn’t hold when you change government policy — just as a matter of simple arithmetic! C(Y) = 0.8Y _may_ not hold when you change government policy for complex behavioral reasons.

If that doesn’t convince you, ask yourself: Do you think you could find a single ‘Keynesian’ sympathetic to the Econ 101 model who agrees that your characterization of its logic in your most recent post is accurate? I guarantee that you will not, and I guarantee that each one you ask will say the same thing — that while it’s true that C(Y) = 0.8Y is a dodgy assumption for the real world, E=0.999999Y is a dodgy assumption even within the model itself.

Nick J:

I guarantee that you will not, and I guarantee that each one you ask will say the same thing — that while it’s true that C(Y) = 0.8Y is a dodgy assumption for the real world, E=0.999999Y is a dodgy assumption even within the model itself.

And my reply to this is:

First, E=.999999Y is *not* a dodgy assumption within the model itself, because the model takes it as given (and invariant under policy changes). An assumption of the model cannot be dodgy within the model.

The fact, then, is that we have two models, each of which makes an assumption that’s perfectly correct within the model, empirically accurate under current policy, but dodgy for the real world when policy changes. That’s more symmetric than you’re acknowledging.

@Steve Landsburg

There still seems to be something fundamentally different even within the model between the two assumptions, but I can’t put my finger on it, so I guess you might be right. I have to think about it.

This proves to the ignorants that the keynesian multiplier is a total absurdity!

This argument is not quite right. First of all, look at the marginal propensity to consume at any given time t. This is used in a very very simple model of consumption, specifically the one used by Keynes, and it assumes that current consumption is based only on current disposable income, and that it is linear. In reality, we can work this through with a more complex model in which the consumption function is more realistic, for instance, one that takes into account things like wealth effects and credit constraints. Using a more realistic model, we still do get instantaneous multipliers. The argument you’ve presented is total fakery and depends on tricking the reader into seeing the ‘Landsburg assumption’, which is totally unrealistic as comparable to the ‘Keynes assumption’ about the consumption function. I don’t know what people teach in economics 101, but in Econ 402 at University of Michigan, we covered consumption functions before even looking at IS-LM, probably to avoid falling into the territory of this critique.

The real cool thing about the multiplier is that when you become a columnist for a famous newspaper you don’t even have to do the math: you can take it as a given.

>>>Harold wrote: “The Govt buys $1 services from me . . .”

From where did Govt get that $1?

Govt got that $1 to spend on Harold by first redistributing it away from me; I now have $1 less to spend on something, and thus, GDP has shrunk by $1.

This is nothing but the old Broken Window Fallacy in a cheap tuxedo. Shame on those who do not recognize it.

>>>Harold wrote: “It only occurs because there is spare capacity . . .”

There is no such thing as “spare capacity.” “Capacity” is either being employed NOW, or being held for employment LATER; it’s not “spare” in the sense that Keynesians accept that term, i.e., as having no particular use whatsoever.

“Capacity” is empoyed in both cases: either now or later.

A “spare tire” is not a tire that has no use and is therefore “lying idle.” A “spare tire” is fully employed _contingently_, against the future possibility of a blowout of a presently employed tire.

And for the record, there’s no such thing, in the Keynesian sense, as “spare change.”

The problem here is that Keynesianism doesn’t recognize any time-frame except the immediate present.

>>>Erik wrote: “Harold, doesn’t your argument leave out the bit where government taxes me a $1 to buy your services, thus reducing my saving by 20c and my spending by 80c, and reducing someone else’s spending by 64c and so on?”

BINGO!

The Keynes’s “Multiplier” is simply Bastiat’s “Broken Window Fallacy” wearing a cheap tuxedo.

“held for employment LATER; it’s not “spare” in the sense that Keynesians accept that term, i.e., as having no particular use whatsoever.”

In Keynesian terms, these people are unemployed. Some economy-level capacity is always expected (full employment is around 3% unemployment). But once we go higher, there really is idle capacity doing nothing.

Bastiat’a fallacy itself is a fallacy – under certain conditions, broken windows do stimulate demand.

>>>under certain conditions, broken windows do stimulate demand.

Under ALL conditions, broken windows do stimulate demand . . . for windows. And that new demand entails less demand for “not-windows”, i.e., new suits, new shoes, new iPads, new vacations, new courses at school, etc.

Bastiat’s example must always hold true because it illustrates a fundamental logical relation between spending and opportunity cost: if you spend $X on (A), then you cannot, at the same time and in the same respect, spend that same $X on (not-A).

In short, Bastiat’s “Broken Window” story is really Aristotle’s “Law of Excluded Middle” put in the form of a parable (“Either (A) or (not-A), but not both”).

@psvt

“under certain conditions, broken windows do stimulate demand.”

Stimulating specific demand is not the problem here! There is a destruction of global wealth. Rather than breaking windows to provide work for glaziers you can give them the money directly related to repair work. In both cases, the overall wealth will be reduced by the amount that others will be allocated to glaziers just to maintain the same number of non-broken windows.

@khodge,

Now Krugman doesn’t do math. If you’re taking this post seriously you have no idea what you’re talking about.

@Economic Freedom:

The problem is that what you’re saying only holds if you don’t treat money as a commodity in Say’s Law. The problem is that demand for windows must first crowd out demand for cash before it starts crowding out demand for playstations. However, if you have too much demand for cash, then that means you don’t have enough aggregate demand for non-money goods. It’s fine to take away demand for cash in a recession. It’s not crowding out in that case.

Daniel 26 –

1) I see precious little evidence that it’s easier to cut spending than to raise taxes (e.g. just don’t pass a new budget and lock in those stimulus levels);

2) In any event, my understanding is that the notion that fiscal expansion is literally *self-financing* is a fairly new ‘strong form’ version a la Summers-DeLong 2012, specific to conditions of a prolonged slump following a financial crisis (like pronounced hysteresis effects and interest rates < growth rate…the authors note that the opposite mantra held sway in the Clinton era – cut the deficit and growth will follow…yes under more ‘normal’ conditions which is the point). Of course the key question is whether one can tell proactively when those conditions will apply. My real point was just that it seems to require considerable hubris for some who are pushing stimulus so adamantly on these grounds but ridiculed the analogously “strong” supply side claims. (For my part I think regulation may be the more important part of the supply side tale.)

Daniel, it is standard practice in economics to reduce an argument to its simplest form, for example Prof Krugman’s babysitting circle on which he seems to base his entire monetary policy analysis.

Without once addressing Steve’s post, you obfuscate (“a whole lot of other assumptions” #8), make pointless observations (“would not support a multiplier of 5” #13), illustrate that you missed the gist of the argument (“I just didn’t think Landsburg was being serious” #14) and babble standard Keynesian nonsense (“govt spending to ward off depression is a temporary measure” #26).

Try understanding the original post before you start attacking Steve’s commenters and then post a comment that suggests you actually did figure out what the post was about.

@khodge,

My whole point was that Landsburg’s post is irrelevant, since it’s not at all what Krugman or any other prominent Keynesian today believes, so what was the point of the post?

He’s mischaracterizing what Krugman means when he says econ 101 would give us a better guide to policy right now than the policy course we’re currently pursuing and assuming Krugman doesn’t know the more complicated assumptions behind a complex model, which anyone that’s read Krugman would know that he does know those more complicated assumptions.

Go read the plethora of other posts refuting the simplifications that Landsburg goes through in his post, that make it not resemble the Keynesian cross.

Your addition in 40 was just a generic insult to Krugman without any evidence and also I might add was irrelevant to the post.

@Iceman 49

1. Except that the stimulus plan did end and planned government spending is decreasing. Look at the expected deficit for this year as compared to last year. Also, permanent tax hikes are difficult to reverse. Even the pseudo permanent 10 year time horizon one’s that Bush had planned were never completely reversed, so that’s an example of how difficult they are to reverse. Whereas the majority congressional party in either house can threaten to hold an economy hostage to force spending decreases whenever they find it convenient.

2. I do see your point. I think we’re not certain about whether it will definitely reduce debt/GDP ratios, but even if it doesn’t that doesn’t by itself eliminate the case for stimulus. Persistent high unemployment causes lot’s of supply side shocks that we need to weigh against the costs of added debt in the long-run.

>>>HJG wrote: The problem is that demand for windows must first crowd out demand for cash before it starts crowding out demand for playstations.

To paraphrase Slim Pickens in “Dr. Strangelove”: “I’ve been to two World Fairs and a rodeo and that’s the STUPIDEST thing I’ve ever read on a computer screen!”

1) When you’re at the supermarket and you’re torn between the agonizing decision whether to purchase apples or oranges, no one — not even Krugman — would claim that in order to purchase, i.e., demand, apples, you must first “crowd out” a purchase, i.e., a potential demand, for oranges.

When you’re purchasing a new window to replace one that is broken, you’re not “crowding out” the desire to hold onto your cash for an unspecified future purchase (“demand for cash”); nor are you “crowding out” demand for a new suit, or new shoes, or anything else. To choose “A” over “B” is NOT an example of “crowding out B.”

To demand “X” over “not-X” is not an example of crowding out “not-X.” And that applies to anything that is “X” and all things that are “not-X,” including cash and consumer goods. When you choose to hold cash, you are CHOOSING TO HOLD CASH; you’re not “crowding out” a purchase of new shoes; conversely when you choose to purchase new shoes, you are CHOOSING TO PURCHASE SHOES; you’re not “crowding out” a choice to hold cash for some future purchase.

That’s an utterly ridiculous use of the phrase “crowding out,” and yet, that’s what you meant by it above.

2) When shopkeepers suffer broken windows, you don’t have to worry whether or not they will pace back and forth for 10 years trying to decide whether to keep the cash in their pocket or spend it on a new window. I mean, THEY NEED A WINDOW!

Excuse me, HJG, but you’re pretending to be worried about a “problem” that simply doesn’t exist in the real world; at least, not with actual human beings on planet Earth. Keynesians sound like people who have simply never owned a business, or run a business, or done anything practical in the real world where things run down, run out, break, get broken, conk out, age, get stolen, etc. Their inner monologue runs like this:

“Oh my God!!! If windows don’t get broken, what will become of the glaziers? And if, by luck, windows DO get broken, how can we be sure that the shopkeeper will actually demand a new window and not demand cash, keeping it idle in his wallet for the sake of it? This is a BIG problem! We just can’t trust those shopkeepers!”

>>>However, if you have too much demand for cash,

The phrase, “Too much demand for cash” means “I disapprove of the present choices of consumers to hold onto their cash for the sake of making purchases in the future.” That’s all it means. Since consumers cannot eat cash, it’s obvious that “the demand for cash” means “the demand for a future purchase rather than a present one.”

Sorry to sound crass, but who the heck are you to tell consumers that the present is more important than the future in some sort of absolute sense?

>>>then that means you don’t have enough aggregate demand for non-money goods.

Say’s Law holds supreme, always and everywhere. It’s like inertia in physics. It cannot NOT hold true. Since, according to Say’s Law, “supply”, at base, IS “demand”; and “demand”, at base, IS “supply”, it follows that there’s no such situation as not “enough aggregate demand,” because that must also mean that there’s not “enough aggregate supply.” They two are the same thing.

You wanna know who has a problem with not “enough aggregate demand” because there’s not “enough aggregate supply”? Places like Cuba, North Korea, lots of places in Africa, Asia, etc. They don’t have enough aggregate demand because they don’t produce anything, i.e., they lack aggregate supply.

But the U.S.?

There’s no such thing — period — as “not enough aggregate demand.” “Demand” can slacken in the X industry, as the not-X industries experience more demand (and vice versa). Demand can slacken in ALL industries IN THE PRESENT, as some, or all industries IN THE FUTURE experience more demand . . . that’s known as “saving”.

>>>It’s fine to take away demand for cash in a recession.

This is Orwellian Newspeak gobbledygook for “let’s inflate, and plant the idea in the consumer’s mind that the purchasing power of each individual dollar is declining; that will encourage him to spend NOW, before prices of windows and other consumer goods catch up to the inflation-caused salary increase he just received at work. That will surely ‘take away demand for cash,’ since why would he choose to hold cash if he suspects it’s declining in value? And if the inflation-caused higher prices of consumer goods are ultimately paid by those on fixed incomes — the poor, the elderly, retirees, pensioners, etc. — who cares! That’s for someone else to worry about!”

Nice policy, HJG. I hope you fully understand that THAT’s what you actually mean when you breezily say “It’s fine to take away demand for cash in a recession.”

Economic Freedom takes his trolling seriouzly!

@HJG,

To offer a much shorter answer to your point, consider this.

If the householders were holding cash against some perceived future need, and you break their windows, they will indeed spend the cash to fix the windows today, employing glaziers who will employ others in turn.

However, now the householders won’t have as much reserve cash as they wanted. So, tomorrow they will start to re-build their reserve, and will NOT go out to dinner. Consequently, the restaurant will do less business, and so forth.

When the government decides that people are “saving too much and not spending enough”, and decides to spend their money for them, they respond by withholding spending elsewhere (see what’s been happening to the savings rate lately).

Three things cause people to want more reserves (and therefore spend less): economic uncertainty, higher living costs (including government costs), and the prospect/risk of higher living costs in the future.

@ThomasBoyle,

“Three things cause people to want more reserves (and therefore spend less): economic uncertainty, higher living costs (including government costs), and the prospect/risk of higher living costs in the future.”

And what happens if everyone is economically uncertain at the same time because of exogenous shocks caused by a bloated and unregulated financial sector?

@Thomas Boyle,

Not really sure what you mean by, see what’s happening to savings lately. This is savings – investment over the past 5 years. In a full employment economy this number is supposed to be 0. It’s moving in that direction, but was super high for 5 years compared to the historical rate of about 0.

Forgot to post link.

http://tinyurl.com/pkj89t2

SL and Nick J: SL says “The fact, then, is that we have two models, each of which makes an assumption that’s perfectly correct within the model, empirically accurate under current policy, but dodgy for the real world when policy changes. That’s more symmetric than you’re acknowledging.”

Nick finds some difference but cannot out his finger on it. Nick has said it already. The assumption that E=0.999999Y we know for a fact will not survive the change in policy. The assumption that C(Y) = 0.8Y *may* survive the policy change. If we can think of a good reason why it should survive the policy change, then our equations *may* become justified. The Landsburg multiplier can never be justified because we can prove that it changes when the amount of money Landsburg has changes.