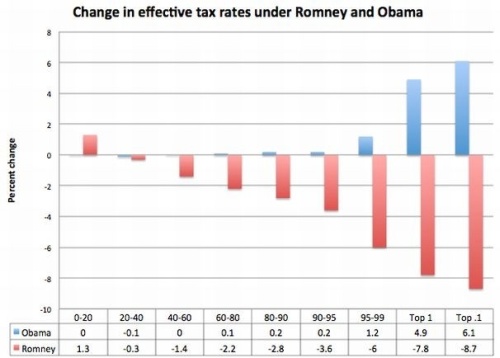

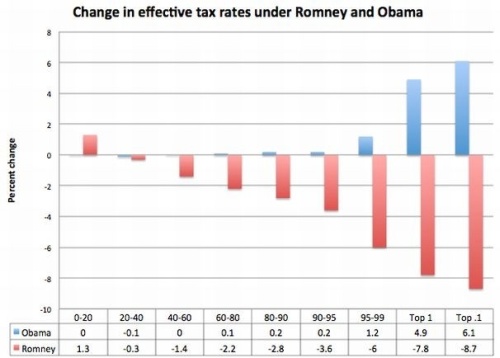

Ezra Klein, quoted with approval by Paul Krugman, offers this chart of how the Obama and Romney tax proposals will change rates for taxpayers in various quintiles:

What we’re supposed to infer, according to Krugman, is that

we have an election in which one candidate is proposing a redistribution from the top … downward, mainly to lower-income workers, while the other is proposing a large redistribution from the poor and the middle class to the top.

But no such thing is remotely true. What we actually have is an election in which both candidates are proposing massive redistributions from the top downward, one slightly less so than the other. You’d never know this from looking at Klein’s chart because it illustrates changes in rates, whereas what actually matters is the rates themselves. It makes no sense to ask whether any particular group ought to be paying more or less without reference to how much they’re already paying.

Indeed, this is a classic example of what I once called the “Grandfather Fallacy” — by focusing on changes instead of absolutes, Klein’s chart conceals any existing inequities and hence treats them as “grandfathered in”.

Fortunately, Greg Mankiw has provided the numbers that allow us to make the requisite correction. Here, according to Mankiw, are the current tax burdens on various income groups (counting transfers as negative taxes, as of course one should):

Bottom quintile: -301 percent

Second quintile: -42 percent

Middle quintile: -5 percent

Fourth quintile: 10 percent

Highest quintile: 22 percent

Top one percent: 28 percent

That “-301 percent” means, for example, that a typical family in the bottom quintile receives $3.01 in net transfers for every $1 that it earns.

By adding these numbers to the numbers in Klein’s graph, we can construct a picture that actually depicts something interesting, namely the projected tax burdens for each group. It looks like this (the vertical axis represents percentage of income):

Note, for example, that, contrary to the impression you might have gotten from Klein’s and Krugman’s posts, both plans place the highest percentage burden on the top 1%, and both plans place a negative burden on the middle quintile — though Obama’s does both of these things to an ever-so-slightly greater extent than Romney’s does. There’s room for disagreement about which plan is fairer, but no room, I think, for disagreement about which chart is relevant.

Continue reading ‘Charting the Tax Plans’