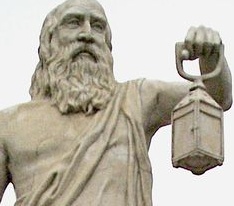

Chapter 8 of The Big Questions is called “Diogenes’s Nightmare” and argues that: 1) In a world of honest truthseekers, there would be no disagreements about matters of fact; 2) In the world we inhabit, disagreements about matters of fact are ubiquitious; therefore 3) in the world we inhabit, there must be precious few honest truthseekers.

Chapter 8 of The Big Questions is called “Diogenes’s Nightmare” and argues that: 1) In a world of honest truthseekers, there would be no disagreements about matters of fact; 2) In the world we inhabit, disagreements about matters of fact are ubiquitious; therefore 3) in the world we inhabit, there must be precious few honest truthseekers.

If you’re looking to ferret out one of those rare creatures, your best candidate might be a man who argues with eloquence and passion against subsidies for the industry where he makes his living. Meet David Bergeron.

David is the founder and president of Sundanzer, which supplies solar powered refrigerators worldwide, based on technology developed by David under contract to NASA. He also really really really understands why subsidizing solar technology is a terrible idea. And when I met him last week, he impressed me so much that I invited him to make a rare guest post here at The Big Questions. So without further ado:

David is the founder and president of Sundanzer, which supplies solar powered refrigerators worldwide, based on technology developed by David under contract to NASA. He also really really really understands why subsidizing solar technology is a terrible idea. And when I met him last week, he impressed me so much that I invited him to make a rare guest post here at The Big Questions. So without further ado:

In a recent Economist on-line debate, the affirmative motion “This house believes that subsidizing renewable energy is a good way to wean the world off fossil fuels” was surprisingly defeated.

In his closing remarks, the moderator softened his strident opposition to the negative case, even admitting that “subsidizing renewable energy, is wasteful and perhaps inadequate to address climate-change concerns.”

The debate, indeed, reopened the question whether anthropogenic greenhouse-gas forcing was a serious planetary environmental concern. But such focus short-changed what I think is the more important question for the Economist. Not only are the renewable-energy subsidies (such as for solar) wasteful and potentially insufficient, they are outright diabolical if indeed there is a looming environmental crisis.

I am not evaluating whether anthropogenic global warming is real and potentially cataclysmic; I’m arguing that if there is a valid concern about the enhanced greenhouse gas effect, not only will the subsidies not solve the problem, but may very well prevent or postpone a legitimate solution.

I’ve written before about why on-grid solar power is absurdly uneconomic and has almost no hope of becoming a viable alternative to current generation technology — or even competitive with other more viable renewable technologies. I’m asking the reader to accept this position for the sake of understanding the potential implication of my claim.

I think it is safe to say that public opinion towards solar is very positive, and there are many in the field claiming that on-grid solar is at or near grid parity. But it only appears this way because of massive governmental subsidies/ratepayer surcharges for installing and using solar PV. In reality, it is hopelessly inefficient from an economic sense to be a fix for our CO2 concerns.

Here is the real problem: Subsidies make solar appear viable today, so where is the motivation for an entrepreneur to risk money, or even focus on developing real energy alternatives when solar is “almost” there? How can an inventor justify striving with the effort it takes to really develop something great when he is competing against a straw man technology which can provide power at almost the same cost of traditional power sources today? But of course it really doesn’t.

The answer is he can’t justify the effort, so the next great thing is not developing, at least not with the sense of urgency it should be. Why enter a contest when you are competing against someone with an unfair advantage? You may be the faster swimmer, but your competitor is using flippers.

Solar subsidies are a placebo which is giving the general public a sense of security about our energy future and is robbing the motivation of those entrepreneurs that could actually address our energy problems. Subsidies are much worse that just wasteful, they’re diabolical. They lull us into thinking we have almost solved the problem and they hinder us from seeking the real solutions.

“Necessity is the mother of invention,” and it’s fairly easy to see this is often the case. Need is a great motivator. We need to feel the pain of our situation to really be challenged and change it.

Leprosy maims it’s victims by robbing them of their sense of pain. The leper can put his hand on a hot surface and not feel the heat. He can twist an angle and will keep walking.

In the same way, on-grid solar subsidies will allow a homeowner to continue using much more electricity than he can afford (or the planet can sustain) and he will not know it. If he felt the pain of the real cost, he would use less power.

But he does not feel it, since subsidies hide the pain, like leprosy.

Subsidies defeat market forces on both sides of the equation. They reduce potential supply by hindering entrepreneurs from developing new energy supplies, and they increase demand by artificially keeping the price of energy down. There could hardly be a more cleverly disguised means of exacerbating a potential climate issue.

If solar PV does not develop into a viable alternative, which I believe it won’t for many decades, not only will we have wasted billions of dollars; far worse, we would have defeated normal protective market forces which would have better prepared us for a potential necessary change in energy use.

In the near term, perhaps our bigger concern than climate change is anthropogenic energy policy.

You can write David directly at david.bergeron@landsburg.com . This is a temporary address, created in a probably futile attempt to minimize spam. David and I have no affiliation beyond some confluence of opinion. I just met him a few days ago.

There is a big difference between subsidising renewable energy and subsidising PV.

The key phrase is here: “If he felt the pain of the real cost, he would use less power.”

The consumer does not feel the real pain of fossil fuel generated power, because the climate effects are an externality. As stated above, “But he does not feel it [the pain of fossil fuels], since subsidies hide the pain, like leprosy.”

This could be addressed with a carbon tax. Otherwise fossil fuels are effectively subsidised, and new energy generation suffers. Direct subsidies for alternative energy may match the hidden subsidy for fossil fuel. So if carbon taxes are not going to happen, then a subsidy seems necessary in principle to restore a free market.

A further purpose of subsidy is to get new technology kick-started by reducing barriers to entry, which are another impediment to a free market. So again, some subsidy seems required in principle to allow free competition.

However, whilst subsidy may be needed, this is not the same as approving all subsidies for all alternative energy. The subsidy must be directed properly.

A test could be applied to asses the long-term viability of the method, the minimum costs that could be expected and the resources needed for large scale capacity. This is not a trivial exercise, but even back of the envelope stuff can show a best-case and worst-case scenario. If the best-case secanario does not look good, then there is no need to go into the details. It may be that PV on roofs falls into this catagory, and should not be subsidised – at least as a method of reducing CO2.

There is so much energy in solar that I feel sure it must be part of the long-term solution. However PV on roofs is not the way to go. Large scale reflective power plants in sunny deserts, with a new DC power grid and molten salt or hydrogen storage might do the trick. This is an investment of billions – maybe trillions – of dollars. There is no chance as long as fossil fuels get the de-facto subsidy.

Other large scale solutions, such as CCS, nuclear and tidal barrages are probably also required. Unfortunately, at least some of the green lobby itself are opposed to these, for a variety of reasons. However, some level of subsidy will be required for these to become a reality.

Great post. Thanks for recruiting such a good guest blogger.

I knew David’s name sounded familiar. I’ve read a number of his fine articles over at Master Resource:

http://www.masterresource.org/?s=David+Bergeron

From one of those posts: “The real cost of the PV is not just its cost, but also the cost of the back-up plant.”

@Harold: I agree that a carbon tax could effectively reverse the externality in question, but then why continue to subsidize anything? You’re still falling into the same trap that got us solar PV: the politicizing of the energy discovery process.

We can introduce a carbon tax that leaves consumers and producers near equilibrium, and entrepreneurs have the right incentives to create new non-carbon (non-taxable) energy sources that work. The existence of subsidies will continue to plague the process as explained in the blog post, even if other subsidized energy sources aren’t as blatantly inefficient as solar PV. To use Bergeron’s analogy: Just because a tech is a better swimmer than solar PV doesn’t mean it deserves to wear flippers. If it’s such a good swimmer, it’ll keep winning.

Pete: I meant a carbon tax as an alternative to a subsidy – if carbon were priced properly there is no need of a subsidy. This might not be quite true, as these are long term commitments, so investors need to be confident that the tax would remain for the lifetime of the project. If there were doubt about the continuation of the carbon tax, then we would be back in the realm of subsidies.

As a carbon tax seems unlikely, then subsidies are a worse way of addressing the de-facto subsidy of carbon. There is also the slight difficulty that we don’t know what the “proper” price of carbon is – we do know that it is higher than it is priced today.

The reduction of barriers to entry may still justify some subsidy, particularly at the early stages of commercialisation.

I applaud Mr. Bergeron’s arguments and conclusions — but find some details missing in his analysis. While noting a limitation of PV — that it only produces power during the day — he ignores the reality that daytime demand is double the demand in the evening, and that demand rates can be used to shift energy use. While factoring this information into the equation will make PV more attractive, it’s clearly not enough to tip the scales. I think it’s a good idea for truthseekers to acknowledge and present their opponents best arguments.

I will accept for the sake of this argument that the only reason on-grid solar appears competitive is because of subsidies. However, that avoids the question of what subsidies are in place for the oil/coal/gas that solar must compete with. If one was to advocate removing all subsidies for BOTH fossil and non-fossil fuels then I would be in favor. However, right now we have massively profitable carbon-fuel corporations that are fighting tooth and nail to preserve their billions in subsidies and tax breaks. So, really, no. You can’t slam solar for getting subsidized in this current world.

Second, this ignores the question of externalities. I believe Steven has written here about his support of something I also would like to see, a revenue-neutral carbon tax. If the carbon-based energies and renewable energies were required to compete in a world with such a tax then you’d have a stronger case. I understand that solar pv (and other renewables) are not carbon-free. Their manufacture, transport, and installation costs need to be counted, just as we should count the costs of coal mining. Again, set up a level playing field and I’ll accept your argument more readily. But really, right now the carbon-based energies get to look cheaper because they’re able to offload billions in costs to other people.

Finally, a handwave about ‘real alternative energies’ with no idea of what those might be is a fail. If you think there’s a feasible non-subsidized alternative then put your candidate forward for consideration. Since you used a disease analogy, let me use another one: today’s AIDS drugs don’t cure the disease. They’re expensive ways to prolong the life and improve the quality of life of millions of people. Since “real” drugs to eradicate HIV seem to be possible, should we therefore stop all production of the current drugs? I rather think not.

The cost of a negative externality has to be measured by the number of people it affects: the cost of the polluted air I discharge is doubled if there are two people breathing it downstream instead of one. If I cover the costs of one person affected and another moves in with her, the new person has contributed to the costs of the externality.

A great many of the externalities of climate change affect future generations. But I should not be called upon to bear all the costs of my externalities, since I have chosen not to breed.

In other words, instead of charging me to cut my externalities by half, we could reduce human breeding so as to cut the population affected by half. Apart from helping the particular externality problem, cutting down on human breeding would solve a myriad of other problems, of course, from water supply to species endangerment.

Wanton consumption of carbon is not the problem; wanton breeding is.

Without subsidies, solar power can at best supplement electricity generation in the southern states. Interestingly, it *should* already be commercially viable to install solar panels on private roofs in, say, Texas. The reason for that is simple – in Texas and other hot states, peak electricity use aligns exactly with peak solar power production, because peak electricity use is caused by air-conditioning, which isn’t necessary unless the sun is shining.

And a peak kwh is really expensive, because it’s provided by generators which run only a few hours each day and you also have to lay out your entire grid to handle this peak demand. If consumers were charged different rates depending on the time of day, you’d probably see a lot of entirely unsubsubsidized photovoltaic installations in Texas.

What everybody else said.

Subsidies/externalities are PERVASIVE throughout the energy industries. So the argument that subsidies are inefficient relative to a competitive market may have some theoretical merit, but have very little practical merit unless you wield the power to eliminate them. Among the market imperfections I’ve heard about:

– Yeah, there’s that whole global climate thing.

– Most consumers of electricity pay a uniform rate per unit of energy consumed – a price that does not vary through the day or year to reflect the varying cost of producing/delivering that energy. This fact tends to subsidize energy consumption during the middle of the day (coincidentally, when solar power is most productive, but wind power is least productive).

– Wind turbines kill eagles/bats/migrating birds protected by international treaty. Consequently some turbine operators must estimate the number of deaths they will cause each year and obtain “takings permits” from US Fish & Wildlife Service for these deaths. In the meantime, studies quantify how many human beings with asthma die each year for each megawatt-hour of electricity generated from coal-fired power plants, yet no “takings permits” are required to operate such plants.

– Federal law limits the liability nuclear plant operators face for nuclear disasters, but do not limit liability for other sources of energy.

– Petroleum firms receive a variety of subsidies – some reflected in the tax code; some reflected in wars in the Mideast.

I share Bergeron’s view that poorly designed subsidies can impede efficient solutions. But I cannot embrace the argument that we can improve upon the status quo by eliminating ONE subsidy while ignoring all the others. If, for example, we’re concerned about offsetting the externalities associated with CO2, and if we can’t simply tax CO2, then we should subsidize alternatives uniformly. A well-designed subsidy would seem to address Bergeron’s concerns about undermining incentives to pursue even better options than solar power.

Yeah, designing subsidies is easier said than done, I know. But taxing CO2 hasn’t proven to be especially easy either. We’re deep into the world of second-best solutions here. It’s unclear to me that Bergeron gets that.

nobody.really:

If, for example, we’re concerned about offsetting the externalities associated with CO2, and if we can’t simply tax CO2, then we should subsidize alternatives uniformly.

But this, of course, is quite impossible since nobody knows what the alternatives are. They are still being developed, in laboratories, garages, and people’s heads. So the solution is not to subsidize in advance, but to reward success. A tax on CO2 accomplishes this, but if that’s impossible, there are other ways to design rewards that don’t try to guess in advance who the winners will be.

Minor point, but I am not sure that SunDanzer’s products are in the same market as the grid-solar things he is objecting to the subsidies for, so “against subsidies for the industry where he makes his living” may not be entirely accurate. Also, the contract to NASA under which the products were developed was presumably with public money, so was a sort of subsidy. This in no way weakens any of the points he is making regarding grid-solar power, which are quite capable of standing on their own merits.

Subsidies for alternative enrgy seems to be driven more by politics than science or technology. I believe that subsidies are required – whilst also believing that the current ones often go to the wrong things. We could throw up our hands and say “well, they will always go to the wrong things – that is how Governments work!” I think it better to identify where they could be better directed.

A rough starting point is the cost per ton of carbon saved. This allows direct comparisons betrween different methods. Curently, as suggested by the author, conservation comes out top, with a negative cost per ton of carbon. Cash for cluinkers comes in at about $400 per ton. The UK’s feed-in tarrif will cost about $6oo per ton for micro PV and micro grid wind.

George Monbiot has had a go at this, refering to a McKinsey report: “It found that you could save a tonne of CO2 for £3 by investing in geothermal energy, or for £8 by building a nuclear power plant. Insulating commercial buildings costs nothing; in fact it saves £60 for every tonne of CO2 you reduce; replacing incandescent lightbulbs with LEDs saves £80 per tonne.” http://www.monbiot.com/2010/03/01/a-great-green-rip-off/

Given current trading values of CO2, nuclear power looks pretty cheap.

Nobody has a well-reasoned economic arguement that rests on his “facts” about petroleum firms. However, his “facts” are the complete opposite of the truth.

Please explain to me how U.S. military spending and wars in the Mideast are a subsidy to my oil company. They are a subsidy to oil consumers. When Saddam invaded Kuwait, oil prices shot-up. When the U.S. invasion began, oil prices fell $10/barrel, that very day.

If Iran blocks the Straits of Hormuz and launches a few missiles into the Saudi oil export facilities, I think oil prices will go up. I think U.S. carrier groups provide a deterrent against this. Obviously the deterrent will have to be punishment after the fact, so it may not be effective against the Iranians.

I frequently hear left-wingers spout off that U.S. military spending is a de facto subsidy of the oil industry. (Excluding Nobody – I don’t know your politics.) What is the basis for this seemingly inane argument?

Secondly, could some of the posters that keep talking about subsidies for the oil industry please send me some links? I run a very small oil company and do not receive any subsidies. My CPA must be an idiot not to take advantage of all of the oil industry subsidies that are constantly mentioned in discussions such as this.

The oil industry in Kansas pays several taxes at the county and state level that are based on top-line revenues, not profits. I have had some wells in bad months where taxes exceeded 100% of profits. That 105% tax rate is a hell of a subsidy.

At the federal level there are absolutely zero subsidies. There is nothing that can turn an unprofitable well into a profitable venture. There are some pretty good tax deductions. In some good years where we had big profits, instead of a monumental tax bill, I had the good fortune to only remit a massive tax payment to the federal government.

Perhaps we’re using the word “subsidize” differently. I think of carbon offsets as a subsidy. Government can create incentives for firms to offset their carbon emissions. An agency certifies offsets, but leaves a lot of discretion to entrepreneurs to devise ways to reduce carbon emissions.

Similarly, the US Federal Energy Regulatory Commission is facilitating the creation of “aggregators of retail customers” (ARCs) — entrepreneurs who enlist people in reducing their energy usage (typically during periods of peak demand) in response to incentives. FERC doesn’t dictate HOW the ARCs get the reductions; it just wants to measure that the demand is actually reduced.

That sort of thing.

I often tell my AGW concerned friends that subsidies are not a good substitute for a carbon tax. Subsidies are a way for politicians to hide a tax and display a benefit, which is want politicians do best.

Even a carbon tax, though much, much better, is not sufficient. It should be coupled with a payout for removing co2 from the air because it might be much cheaper to remove co2 from the air than to not put it there. One promising scheme for removing co2 from the air is biochar.

Supporting subsidies for “green” energy is asking to scammed by the politicians.

One thing that allows politicians to get it over on voters is that most voters do understand the incidence of taxation. They do not even think about it at all. They assume that the only cost of Government action is to those who sign the tax checks.

@SheetWise: I strongly agree that we should always and vigorously present the arguments of our opponents in the best possible light. But this post was not intended to cover all the arguments in favor of solar, just the negative effects of subsidies on supply and demand.

The fact that utilities use more power during the day is not ignored in the financial analysis of PV. Dr. Severin Borenstein has written several good papers on that topic.

Even in the best light, on-grid PV is about 4x too expensive to be viable in most places, such as my state of Arizona.

Hm. Maybe so.

But if you’ve followed the news since then, you might have noticed that Saddam withdrew from Kuwait – and we started a new war in Iraq anyway. The first hit on my Google search is a 2008 Washington Post article saying —

While this dynamic may have escaped your attention, I’d be surprised if it escaped the attention of the oil men in the Executive Branch.

@Alan Wexelblat: Here are a few papers which discuss subsidies to renewables v. traditional power plants.

Subsidies to wind + solar are greater than subsidies to coal + natural gas + nuclear combined, yet the latter produce about 20 times more electrical energy.

Source: Energy Information Administration, Direct Federal Financial Interventions and Subsidies in Energy in Fiscal Year 2010, July 2011,

http://www.eia.gov/analysis/requests/subsidy/pdf/subsidy.pdf

Also see,..

http://www.instituteforenergyresearch.org/2012/05/31/12704/

http://www.instituteforenergyresearch.org/2011/08/03/eia-releases-new-subsidy-report-subsidies-for-renewables-increase-186-percent/ < IER Summary

http://www.eia.gov/analysis/requests/subsidy/pdf/subsidy.pdf < EIA full report on subsidies

If you look closely at the nature of the subsidies, they seem quite different between the industries. Solar and wind get hard cash $$ for using and producing power. But white collar workers in Morgantown studying fluidized bed combustion are considered a subsidy to coal.

Many of the coal and gas "tax" subsidies, are available to all industries or can mostly be considered as normal accounting practice. They appear high for the traditional energy industry simply because the traditional industry is so large. For example, if you give the coal industry a 1 cent per kWh subsidy and you give solar a 10 cent subsidy, the coal subsidy will be much larger in absolute terms because coal generates so much more power, but to me, the 10 cent solar subsidy is higher. I think it is more intellectually honest to look at the subsidies on a per kWh bases, not absolute.

@nobody.really: Please seem my comment to Alan. I think using the “fossil fuel subsidies” argument as a justification for solar subsidies is not valid. The proponents of this argument tend to exaggerate the subsidy to traditional energy sources.

Internationally, the case for fossil fuels subsidies is legitimate, because several countries sell oil to its citizens at below market rates.

@Harold: The point of the argument is that subsidies to solar may very well be hindering our planet’s transition to better energy sources.

Many people say that since a carbon tax is politically impractical, we should pursue politically tolerable subsidies for on-grid solar, but I cannot agree.

A carbon tax would reduce CO2, but solar subsidies might exasperate the CO2 problem.

If we don’t have the political will for a carbon tax, then rather than mandating subsidies for solar, we should do nothing. The 1st rule of medicine: “do no harm.”

Trust price signals work to reduce consumption and increase legitimate alternatives.

David: Thanks for taking the time to reply. It’s possible your argument is more nuanced than is presented in this blog post, or perhaps I misread it – I seem to do that.

I read you to be saying “the only reason grid pv appears competitive with grid fossil fuel is because solar is subsidized.” My objection was that the sentence should be “the only reason grid pv appears competitive with grid fossil fuels that are subsidized is because solar is subsidized.” Therefore the fact that subsidies exist is not per se an argument against grid solar pv.

Your argument now appears to be “the only reason grid pv appears competitive with grid fossil fuels that are subsidized is because solar is subsidized more.” I’ll accept that as true for the sake of argument and point you to item 2 in my response, about externalities. My sentence would then be “a reason that grid pv appears more expensive than grid fossil fuels is because the production of fossil fuels involves costs that are paid by other people and not reflected in the stated price. If you reflected more of the true cost via (my preferred method) a revenue neutral carbon tax on both kinds of generation I believe the balance would shift.”

I would further add a point 4, which is that this country has traditionally heavily subsidized things that appeared commercially non-viable, particularly in their infancy. This very Internet being a prime example, and you could make similar cases for biogenetics, nanotechnology, and other things that would not have made it to commercial viability without massive government support during a period when they were not commercially viable.

You might argue that the government should not be in that business at all (which seems strange given your company’s stated genesis) but unless you’re opposed to all federal subsidies it seems strange to single out solar pv as uniquely bad in this regard.

David B. It is an interesting point – the wrong subsidy not only wastes money but makes the situation worse. This could be the case, and I agree that subsidising grid-solar is not a useful. I am not sure how much harm it actually does because the amount of power is likely to be small.

However, just because subsidising grid-solar is not useful does not mean that we must do nothing. Appropriate subsidies would reduce CO2 emmissions. For example, subsidy of CCS will be necessary, because CCS must add cost to power generation. If a reasonable subsidy of say $10/ ton of carbon would pay for the difference, then this subsidy would reduce carbon emmissions. Nuclear will probvably require some subsidy, if only by taking on some of the risks or costs of decommissioning. Perhaps a rule of thumb is that subsidies in the region of possible carbon trading prices – say $20-30/ton, would be a viable and useful level.

@ nobody, so you wish to double-down on the inane economic conclusion about the military and oil prices?

Your google search turned up a 2008 article that notes how much oil prices have risen since the 2003 invasion. Good thing there were no other geopolitical events in the intervening five years that could have affected oil prices. How about using google to check something like Chinese oil demand growth rates from 2003 to 2008?

A far more relevant economic point would be the consequences of the actions of the U.S. military. Now if I was influential oil man with enough power to get the U.S. military to do my bidding, I would have had the military destroy the oil fields and the Iraqi export facilities. Instead, they rushed to defend the oil fields and infrastructure. Apparently, under the quaint notion that the newly liberated Iraqi populace would need the oil revenues to rebuild their post-Saddam nation.

I agree that the net effect of the Iraqi war was to raise oil prices. However, if you listened to some of the “neocons” in the run-up to the war, a fair number thought Saddam could be easily swept aside and the U.S. would be treated as conquering heros. Under this “planned” scenario, Iraqi oil production would go up, not down, as international oil companies teamed up with the new government.

This dynamic did not escape me, but then again I think for myself rather than link to articles written by journalists that have next to zero understanding of the oil business.

nobody.really

Even if we concede the net effect of the War on Iraq was to raise the price of oil and the profits of Oil Companies, the net affect on oil as an energy choice was to triple the price. If the US military tripled the world price of PV I don’t think we would call that a subsidy.

Btw, my most important factor for world-wide oil price increases — Hugo Chavez. Check out oil prices since he took over Venezuela. He took a habitual quota breaker and made it the darling of OPEC. OPEC power is at it’s apex now that Venezuela has come in line. Venezuelan, the world leader in proven reserves, has decreased production since Chavez came to office. Domestically, Venezuela sells refined gasoline for 18 cents a gallon (now that’s a subsidy!) — frivolously wasting precious oil and needlessly increasing CO2 emissions.

I suppose I could. But I didn’t see the need, given that the 2008 article in question already acknowledged that dynamic:

In short, I conclude that the Iraq War took oil off the world market at a point when supplies were already tight by historical standards, increasing the price of oil and the profits of US oil firms. Nothing Pillage Idiot has argued leads me to adopt a different conclusion.

Fair enough, but I don’t understand Pillage Idiot’s point. As far as I can tell, US petroleum firms could reasonably expect increased profits by taking over Iraqi oil production. And as far as I can tell, US petroleum firms could reasonably expect increased profits by having Iraqi oil production curtailed. The least profitable outcome for US petroleum firms would be for the US to refrain from starting a war. Low and behold, the US did not pursue the option that would predictably generate the least profits for US petroleum firms. If Pillage Idiot is trying to argue otherwise, I haven’t understood the argument.

This is the better point – and illustrates the irony of my conversation with Pillage Idiot:

At comment 10, I remarked, “Petroleum firms receive a variety of subsidies – some reflected in the tax code; some reflected in wars in the Mideast.”

At comment 13, Pillage Idiot objected to the idea that wars in the Mideast might profit US oil firms, stating

In stating “They [US wars in the Mideast] are a subsidy to oil consumers,” Pillage Idiot conceded my point. I had not alleged that wars in the Mideast subsidized anyone’s oil company. Nevertheless, I’m happy to oblige Pillage Idiot by noting when a war in the Mideast did have the effect of subsidize oil companies; the example is not buried to deeply in my memory yet. But this is really tangential to the larger point of the blog post.

Alternative energies have negative externalities as well.

Think energy sprawl. Wind energy has very low power density due to bad aerodynamics if placed too close together: 2 W/m2. So it needs lots of space. It uses a disproportionate amount of steel and concrete. (Robert Bryce, Power Hungry)

Think off-shoring of pollution. Neodymium used to make magnets in wind turbines is mined in Mongolia. Matt Ridley: http://www.rationaloptimist.com/blog/rare-earths-versus-the-earth.aspx

A famous economist once said “there are no solutions, only trade-offs”. So which trade offs are better? Has wind, or solar, or geothermal lowered our carbon emissions back to 1992 levels? Nope, but nat gas under good old market-driven forces has helped do so:

http://mjperry.blogspot.com/2012/06/climate-change-stunner-us-leads-world.html?m=1

@Alan Wexelblat: I think it is safe to say that subsidies to fossil fuel electricity have a negligible effect on the price of power from those sources. Not only is the subsidy per kWh low, but the subsidies are indirect.

I’m not sure you would notice a change in your electric bill if those subsidies ended.

From the third link I posted,

Cents/kWh subsides levels are:

Coal 0.064

Gas 0.064

Wind 5.6

Solar 77.5

Wind and PV are dependent on government support. If the subsidies (and mandates) ended, the on-grid solar market would vanish like a ninja.

Regarding the externalities argument, if you were to imagine a carbon tax and its effect, I think you would be able to suggest 100 lower cost ways to reduce CO2 than installing solar PV. The market would do this very well if we gave it the chance. Carbon trades for about $10-20/ton in the EU but saving CO2 with PV cost about $130/ton.

And in case some might be tempted to add the cost of the Middle East wars to the externalities argument for promoting solar PV, please keep in mind that we do not use oil to make electricity.

Regarding your point that we have in the past subsidized other industries, I will admit that the government does on occasion fund a winner, but sometimes people like Mao will decide that steel is the winner and not agriculture and in the process kill 30-40 million people by fighting market forces. I just don’t think it is worth the risk to let the government play in the free market.

I am against most all subsidies, and focus on solar because I know the numbers in this field and have to listen to the industry claiming things about solar which I know are not true. People in a field are the best ones to make the case against subsidies. I’m sure Diogenes could find a corn farmer against ethanol subsidies for the same reason.

@Harold: If we agreed that CO2 were a problem, then rather than subsidies to CCS, would it not be better to simply tax CO2 $10/ton and let the market choose the most cost effective solution?

If you haven’t been following the news on Australia’s Carbon Tax, it makes for one of the most fascinating political stories I’ve seen in a long time. Idealism, Despair, Betrayal, Brinkmanship, Deception, a down-to-the-wire vote – no, make that two, Broken Promises and Lying Rhetoric, A Sex Scandal – no make that two, More Betrayal… All that’s missing is a police car chase and a love triangle…

And the next election isn’t till late next year…

Here’s just a bit of the fun from just before the cliffhanger election in 2010…

(or, if the embed doesn’t work, see http://www.youtube.com/watch?v=5itCHEX5hdk )

Now that Nobody has explained it to me, I see why the U.S. military so often gets mentioned as a subsidy to “oil”. It’s the well-known economic theory of “heads I win, tails you lose.”

If the U.S. military intervenes in the Mideast and oil prices fall, then that is a subsidy to oil consumers. If the U.S. military intervenes in the Mideast and oil prices rise, then that is a subsidy to oil producers.

The U.S. military has restrained itself from invading Canada for over 200 years. This non-action has also surely allowed oil prices to either not go up, or not go down, a very large amount. Therefore, we should add several more trillions of dollars on the ledger of subsidies to “oil”.

Looks to me that I must be a honest truthseeker too. I am an investor in a small (1 MW peak)solar power station in one European country. Since I have a lot of technical and some economics background, I have always been saying that the subsidies are a harmful and unfair way of spending taxpayers (or in this case rather enegry consumers) money. The photovoltaic efficiency is still pathetic, coal and gas is cheap, and most likely carbon dioxide is not as bad as the AGW lobby is trying to make us believe (without questioning).

Still, the incentives were high enough that I became investor in one of these solar power stations with substanital part of my lifelong savings. No doubt, people are rational and react to incentives.

Still, I believe that those subsidies are a cruel joke, especially when they are so high to make a solar power station viable north from the Alps (meaning that clear sky is far from certain in my country).

David B: We are in agreement on carbon tax, I think- it would be better to introduce a carbon tax. However, this would add to the cost of all fuel, and all goods, and be political suicide. Instead, subsidies given to a small fraction of power generation makes it look like something is being done, without adding signifiacntly to the cost of most power (and goods). If this can effectively subsidise the middle classes (by a feed-in-tarriff for those that can afford to put panels on their own roofs), then this is politically a win-win, but realistically useless.

I assume therefore that there will not be a carbon tax. In a world without a carbon tax, I argue that some subsidies will be required to “level the playing field” compared to fossil fuels. I also argue that the level of these subsidies should not go to methods that do not have a realistic likelihood of saving, say, $30/ton of CO2. This would rule out solar PV, I believe. The money spent on solar could be spent on conservation for a much greater return of carbon saved.

We are in agreement on grid-solar PV. But this does not mean that we should reject all subsidies.

Pillage Idiot – the USA has not quite managed 200 yrs – they did invade Canada on July 12 1812, and launched a second invasion in October 1812.

http://en.wikipedia.org/wiki/War_of_1812

@Harold:

“You call that an invasion? This is an invasion!”

@Jimbino

“In other words, instead of charging me to cut my externalities by half, we could reduce human breeding so as to cut the population affected by half. Apart from helping the particular externality problem, cutting down on human breeding would solve a myriad of other problems, of course, from water supply to species endangerment.”

Or “we” could simply eliminate ALL human breading, and the many problems you see would be gone in 50 to 100 years.

You are a truly dangerous person, but it’s okay, as your choice to not breed ensures that your views will die with you, whereas mine, which are very different, will perpetuate through my children and grandchildren, making my views more prevalent in the future. For that I thank you.

@Harold

“Pillage Idiot – the USA has not quite managed 200 yrs – they did invade Canada on July 12 1812, and launched a second invasion in October 1812.”

And there you have it: Proof positive that invading a foreign country ensures an abundant future supply of oil. :)

Of course my previous comment should read: “all human breeding” not “all human breading”.

Must read for all progressive liberal environmentalist (like myself). The left habitually mocks the rights inability to acknowledge scientific facts, like anthropomorphic climate change. The blind spot in most liberal thinking is the simple fact that open markets work in finding the best price and pushing efficiency.

My best hope is that the two wings of our sick bird will start working together, using their own strengths while relying on the strengths of the other.

I feel as though a common support for subsidies in alternative energy is “infant industry protectionism”. Those companies need help getting off the ground, but once they do they’ll do wonders for the world!

What would you say to that?

@alex silverman, I would say it is unnecessary to protect the ‘infant’ alternative energy industry. When market conditions are right, they will blossom. Ending subsidies will cause contraction of the industry, but the industry won’t experience any permanent damage.

The slow struggle from a small to large industry is healthy. I think pushing it prematurely enables corrupt government/business interactions.

Time spent in the cocoon does the caterpillar good. I think natural market forces will drive the alternatives sufficiently fast.

But the point of my article is that we are damaging alternative energy development with subsidies and misdirecting consumers to use too must energy. Most of the responders on this article did not seem to embrace that thought.