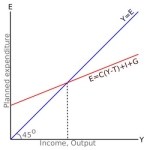

It’s well understood that if you see the world through sufficiently Keynesian eyes, you might welcome a destructive hurricane or the threat of an alien invasion (together with the frantic spending it would stimulate) as just the ticket to lift the economy out of a recession.

What seems to have been largely overlooked is that even in a thoroughly non-Keynesian world where markets work perfectly (or as perfectly as they can in the presence of a distortionary income tax), and recessions cure themselves, we might still want that hurricane.

Or, because we can’t always call forth hurricanes when we need them, we might want our government to simulate their effects by diverting funds from useful to destructive spending projects — or just occasionally showing up at people’s houses and trashing their furniture.

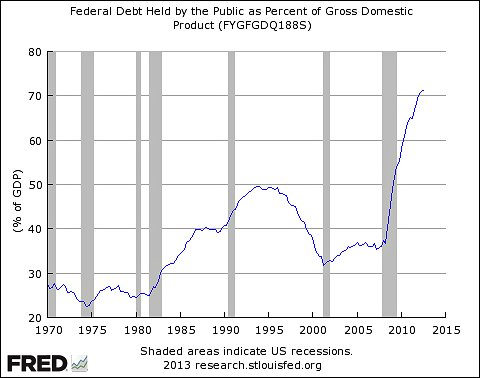

Here’s why: Hurricanes make us collectively poorer. When we’re poorer, we work more. When we work more, the government collects additional income tax revenue. But — taking total government spending as given — the government can’t continue to collect additional revenue forever; sooner or later it must lower tax rates. (This assumes we’re on the good side of the Laffer curve, where the way to collect less revenue is to lower rates, not raise them.) When tax rates fall, labor markets work more efficiently. So much so, in fact, that the efficiency gains can more than compensate for the initial destruction.

I only realized this recently, and it surprised me (along with several others I showed it to) enough that I wrote it up as a short paper. (Update: A more recent version of the paper is here.) I also looked back through my blog archives to see how badly I’d gotten this wrong in the past.