Archive for the 'Rationality' Category

Why do some people sign up to have their brains frozen for possible future resurrection, while others don’t? You might think it’s because the first group has more faith in future technology, but Scott Alexander has survey data to suggest otherwise. Active members of the forum lesswrong.com, many of whom had pre-paid for brain freezing, thought there was about a 12% chance it would work. Among members of a control group with no interest in the subject, the estimate was about 15%.

In a long and characteristically thoughtful blog post, Alexander concludes that:

Making decisions is about more than just having certain beliefs. It’s also about how you act on them.

and

The control group said “15%? That’s less than 50%, which means cryonics probably won’t work, which means I shouldn’t sign up for it.” The frequent user group said “A 12% chance of eternal life for the cost of a freezer? Sounds like a good deal!”

Goofus (says Alexander) treats new ideas as false until somebody provides incontrovertible evidence that they’re true. Gallant does cost-benefit analysis and reasons under uncertainty.

So a few weeks ago when we all thought that the chance of a global pandemic was, oh, about 10%, Goofus said “10%? That’s small. We don’t have to worry about it.”, while Gallant would have done a cost-benefit analysis and found that putting some tough measures into place, like quarantine and social distancing, would be worthwhile if they had a 10 or 20 percent chance of averting catastrophe.

Is it rational to play Megamillions, with the current jackpot of a billion dollars or so?

Yes and no. Here are three questions:

- Are you willing to pay $20 for ten MegaMillions tickets?

- Are you willing to pay $20 for seven weeks’ worth of immunity from fatal lightning strikes?

- I propose to flip a coin. Heads, you get the MegaMillions jackpot. Tails, you die. Do you want to play?

There is no irrational answer to any of these questions. Some people like to play the lottery; some don’t. Some people are safety fanatics; some aren’t. Some, but not all, love huge risks with huge potential payouts.

But there is such a thing as an irrational pattern of answers. I know there are millions who answer yes to question 1, because I see them buying tickets. I’m guessing that almost all of those people would answer no to question 2. And I’m guessing that a fair number of those would answer no to question 3 as well. Perhaps you”re one of that fair number. If so, I declare you irrational.

Ten Megamillions tickets give you about a one in thirty-million chance to win the jackpot. One in thirty-million is also pretty close to the chance you’ll be struck by lightning in the next seven weeks. If you’re willing to buy the lottery tickets but not immunity from the lightning, you’re telling me that winning the jackpot means more to you than staying alive. So you should go for the coin flip in question three. If you didn’t, I declare you irrational.

Well, so what? Some economist called you irrational. Why should you care?

You should care because this is exactly the kind of irrationality that will allow me to take all your money. Keep reading to see why.

But first, let’s acknowledge that I’ve ignored a few things, like the possibility that you’ll win one of the lesser prizes in the lottery. I’m assuming that, compared to the jackpot, those are negligible as reasons to buy a ticket. (This is consistent with the observed fact that a whole lot of people buy tickets only when the jackpot is large.) If you don’t like that assumption, we can avoid it by tweaking the numbers in the questions, in ways that I strongly suspect won’t change most people’s answers.

Now let’s get to the fun part where I take all your money. Suppose you’ve answered yes/no/no to the three questions above. Then I’ll rig up the following experiment: I fill a bag with 30 million white balls, one black ball, and one blue ball. I plan to pull a ball from the bag, but before I do, I’ll make you two offers. You can take them or leave them; it’s entirely up to you.

- A. If you give me $20 upfront, and if I draw the blue ball, I’ll give you a billion dollars.

- B. I’ll give you $20 upfront, provided you allow me to electrocute you if I draw the black ball.

You’ve already told me that you’d pay $20 for ten Megamillions tickets, giving you a one in thirty-million chance at roughly a billion dollars. So of course you’ll happily go for A. And you’ve already told you that it’s not worth it to you to give up $20 to avoid a one in thirty-million chance of electrocution. So of course you’ll also happily go for B.

So: You (voluntarily) give me $20 and accept my $20. So far we’re even. And, I might add, you’re very glad to be playing. You got two things and you wanted both of them.

Now the drawing. Most of the time I’ll draw a white ball, and nothing happens. But occasionally I’ll draw a blue or a black. When I do, I’ll tell you (perfectly honestly, because I’m honestly exploiting your irrationality, not trying to trick you) that I’ve drawn a non-white ball. There’s a fifty-fifty chance it’s black, in which case you will die, and a fifty-fifty chance it’s blue, in which case you win the billion. You are effectively facing the very coin flip that you told me in Question 3 that you prefer to avoid. Of course, then, you’ll gladly pay me a few bucks to call everything off. Now I’m ahead.

We might have to play this game several million times before I draw a non-white ball and take your money, but as long as you’re committed to your stated preferences, you should be willing to play several million times — or to let me set my computer to playing a virtual version for us several million times per hour. In a few hours, I’ll win some money from you. In another few hours, I’ll win more. And so on till you’re broke.

When an economist calls you irrational, it almost always means that if you follow through on your stated preferences, a sufficiently clever opponent can take all your money, leaving you smiling along the way. It’s worth being alert to such things.

If you thought this was fun, you should take the ten-question Irrationality Test in Chapter Six of Can You Outsmart an Economist?. Come back to the blog and let me know how you did.

When I was a child, my parents took me to Atlantic City every summer. And we would always make a side trip to Longport (three towns away) to collect seashells, because my Dad said that Longport was famous for the quality of its seashells.

Last week, on a whim, my wife and I went down to Atlantic City for a few days, largely because it looked like they were having nice weather down there. In a fit of ambition, we walked the entire 16-or-so-mile roundtrip from the Steel Pier area to the far end of Longport. Along the way, I noticed no difference between the Longport seashells and the Atlantic City (or Ventnor or Margate) seashells. Moreover, we met a lifelong Longport resident (and enthusiastic civic booster) who confirmed that she had never in her life heard that there was supposed to be anything special about Longport’s seashells.

Over my lifetime, I’ve accumulated a lot of advice from my father, some of which seemed to make sense. But in light of my trip to Longport, I’m re-evaluating.

The solution to yesterday’s rationality test:

This one is much much simpler (and much less infuriating) than some of our earlier rationality puzzles (e.g. here and especially here), but it has a good pedigree, having come to me from my student Tallis Moore, who found it in a paper of Armen Alchian, who attibutes it to the Nobel prizewinner Harry Markowitz.

Several commenters got it exactly right, but whenever possible, I prefer an explanation that invokes cats and dogs. So: Suppose I give you a choice between A) a cat, B) a dog, and C) a coin flip to determine which pet you’ll get:

|

|

|

It’s perfectly rational to prefer the cat to the dog, and perfectly rational to prefer the dog to the cat, but (according to the traditional definition of rationality) quite indefensible to prefer the coin flip to either.

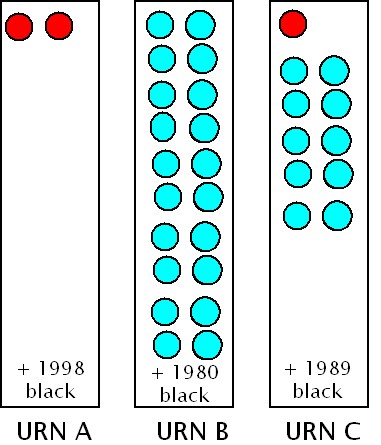

In front of you lie three urns, labeled A, B and C. Each contains 2000 balls. Urn A has 2 reds and the rest black; Urn B has 20 blue and the rest black; Urn C contains 1 red, 10 blue and the rest black. Like so:

You can reach into the urn of your choice and remove a ball. If you draw red, you get $1000; if you draw blue, you get $100; if you draw black, you get nothing. Which urn do you pick and why?

On allexperts.com, we find the following query:

How can I find a list of retail markup % by industry? My husband won’t let me buy new lamps because his mother worked in a lamp store 60 years ago and the markup was “astronomical”. I’m betting that there are plenty of things he buys that have a similar markup as do lamps. I know that the average markup varies between industries (i.e. groceries being very low). Appreciate any insight! Thanks!!!!

Several questions arise, or which the most compelling is: When you buy a lamp, why would you care about the markup, as opposed to, oh, say, the price? In fact, if you’re the sort of person who worries about things like minimizing your carbon footprint and otherwise curbing your resource consumption, you should of course prefer items with high markups, since the markup is the part of the price that doesn’t reflect resource consumption. Or to put this another way: Given the price of the lamp, isn’t it better for the seller to earn more profit rather than less?

Since economic theory tells me that the author of this inquiry is perfectly rational, I see only a small number of possibilities:

How rational are you? I once posted a test, based on ideas of the economist Maurice Allais, that most people seem to fail. Today’s test, based on ideas of the economist Dick Zeckhauser and the philosopher Richard Jeffrey, is one that almost everyone fails.

How rational are you? I once posted a test, based on ideas of the economist Maurice Allais, that most people seem to fail. Today’s test, based on ideas of the economist Dick Zeckhauser and the philosopher Richard Jeffrey, is one that almost everyone fails.

Suppose you’ve somehow found yourself in a game of Russian Roulette. Russian roulette is not, perhaps, the most rational of games to be playing in the first place, so let’s suppose you’ve been forced to play.

Question 1: At the moment, there are two bullets in the six-shooter pointed at your head. How much would you pay to remove both bullets and play with an empty chamber?

Question 2: At the moment, there are four bullets in the six-shooter. How much would you pay to remove one of them and play with a half-full chamber?

In case it’s hard for you to come up with specific numbers, let’s ask a simpler question:

The Big Question: Which would you pay more for — the right to remove two bullets out of two, or the right to remove one bullet out of four?

The question is to be answered on the assumption that you have no heirs you care about, so money has no value to you after you’re dead.

Almost everybody says they’d pay more in the first case than the second. Arguably, that means that in this scenario almost nobody is rational — because a rational person would give the same answer to both questions.

The reason for that is not immediately obvious. To understand it, you’ve got to think about four questions:

1) I just had an extremely pleasant walk around the Beale Street area in Memphis, which strikes me, roughly, as Bourbon Street without the urine. (Also without the trash and the high general level of obnoxiousness — though also of course without the magnificent architecture, etc.) Yes, I realize it’s also a different musical genre (though in both cases it’s a sub-genre of “too loud”). But it’s astonishing to me how clean the streets are here, and how well-behaved the crowds, compared to what I’ve seen in Louisiana. If they can do that here, why can’t they do it there?

2) This weekend marks the anniversary of a world-changing event — an event that might be of particular interest to readers of The Big Questions, both the book and the blog. Who can tell me what event I have in mind? (Hint: It’s an anniversary ending in zero.) I’ll blog the answer on Monday.

3) The discussion of the Allais paradox rages on in comments on multiple posts. For the few of you who have not yet tuned this out, my latest comment is an attempt to cut through the fog and identify the locus of some commenters’ confusion, or disagreement, or both. I think it will very much help focus the discussion if the dissenters could tell us where they stand on these questions. (My answers are all “yes”.)

Leonard Jimmie Savage was a pioneer in modern decision theory and a disciple of Frank Plumpton Ramsey, whose story occupies the final chapter of The Big Questions.

Leonard Jimmie Savage was a pioneer in modern decision theory and a disciple of Frank Plumpton Ramsey, whose story occupies the final chapter of The Big Questions.

In 1954, Savage wrote a lovely and highly influential little book called The Foundations of Statistics, which starts with six simple axioms about human preferences — one of which says that if you prefer a dog to a cat, then you’ll prefer an 11% chance of a dog to an 11% chance of a cat (and likewise for any other percentage). From these axioms, he drew deep and surprising conclusions about human behavior. This work underlies much of modern game theory, decision theory and economics in general.

According to legend (and I have reason to suspect this legend is actually true), Professor Savage was giving a talk one day when he was interrupted by the French econometrician (and then-future Nobel Prize winner) Maurice Allais, who asked Savage if he’d be willing to answer two questions about his own preferences. Savage said sure. These were the questions:

Can ignorance be bliss?

There is allegedly a tradition of issuing a blank cartridge to one (randomly chosen) member of each firing squad, so that no shooter knows for certain that he contributed to a death. Let’s assume that tradition really exists and let’s assume that it exists because the shooters want it. Does that prove that shooters (at least in some instances) value ignorance?

Not necessarily. It might just mean that each shooter prefers a 5/6 chance of firing a real bullet over a 100% chance of firing a real bullet. That’s not the same thing as preferring to be ignorant.

So here’s the key experiment. Offer the shooters a choice:

Continue reading ‘Ignorance, Bliss, and Rationality Re-Redux’

This week we had two posts on the foundations of rationality and two on whether there’s been a recent surge in government spending.

The government spending posts are here and here. It seems to me that the graphs in the second post are dispositive.

The rationality posts are here and here. These led to a lot of convoluted discussion, so let me give you the executive summary.

The rationality quiz that I posted on Tuesday has drawn a lot of comments from folks who think they can reconcile inconsistent answers by appealing to risk aversion. That’s surely incorrect. To see why, let’s start with another quiz.

The rationality quiz that I posted on Tuesday has drawn a lot of comments from folks who think they can reconcile inconsistent answers by appealing to risk aversion. That’s surely incorrect. To see why, let’s start with another quiz.

Question 0: Which do you like better, dogs or cats?

Economists would not presume to declare either choice an irrational one. There’s no accounting for tastes.

Now I have two more questions for you:

The death this week of Nobel laureate (and relativity denier!) Maurice Allais reminds me that I’ve been meaning to blog about Allais’s famous challenge to the way economists think about rational decision making.

The death this week of Nobel laureate (and relativity denier!) Maurice Allais reminds me that I’ve been meaning to blog about Allais’s famous challenge to the way economists think about rational decision making.

I’m going to ask you two questions about your preferences. In neither case is there a right or a wrong answer. A perfectly rational person could answer either question either way. But I do want you to think about your answers, and to write them down before you read any further.

Question 1: Which would you rather have:

- A million dollars for certain

- A lottery ticket that gives you an 89% chance to win a million dollars, a 10% chance to win five million dollars, and a 1% chance to win nothing.

Try taking this seriously. What would you actually do if you faced this choice? Don’t bother trying to figure out the “right” answer, because there is no right answer. Some perfectly rational people choose A, and other perfectly rational people choose B.

Okay, ready for the next question?

Question 2: Which would you rather have:

- A lottery ticket that gives you an 11% chance at a million dollars (and an 89% chance of nothing)

- A lottery ticket that gives you a 10% chance at five million dollars (and a 90% chance of nothing)

Once again, this is a matter of preference. There is no right or wrong answer. But decide what your answer is and write it down before you continue.